Offshore Wealth Management Things To Know Before You Get This

Table of ContentsExcitement About Offshore Wealth ManagementThe Buzz on Offshore Wealth ManagementGetting My Offshore Wealth Management To WorkNot known Details About Offshore Wealth Management Offshore Wealth Management for Beginners

Offshore investments are often an attractive remedy where a parent has actually supplied capital to a minor, or for those who can expect their minimal rate of tax obligation to drop. They likewise provide an advantage to investors qualified to an age-related allocation, or expatriates that are investing while non-resident. In addition, offshore remedies might be proper for investors wanting to spend consistently or as a one-off swelling amount right into a series of property classes as well as currencies.They can supply you with the alternative of a regular revenue and also assist you to reduce your personal liability to Earnings and Resources Gains Tax Obligation. The value of a financial investment with St. offshore wealth management. James's Area will be directly connected to the performance of the funds you select and also the value can therefore decrease along with up.

The levels as well as bases of taxes, and remedies for taxes, can change at any type of time. The value of any tax alleviation depends on individual conditions.

Offshore Wealth Management Things To Know Before You Buy

Many investors use traditional financial investments like an actual estate and also financial items, at taken care of prices. From the lasting financial investment point of view, it can be much smarter to invest in capital holders whose performance is constantly extra eye-catching.

Depends on are excellent investment vehicles to secure properties, as well as they have the capacity to hold a broad variety of asset classes, consisting of building, shares and art or antiques - offshore wealth management. They also enable reliable circulation of assets to recipients. An offshore trust that is managed in a safe and secure jurisdiction permits efficient wealth production, tax-efficient monitoring and succession planning.

The 2-Minute Rule for Offshore Wealth Management

Clients who fear that their possessions may be frozen or confiscated in case of possible political chaos view overseas banking as an eye-catching, secure means to shield their assets. Several overseas accounts dilute the political danger to their riches and decrease the danger of them having their properties frozen or confiscated in an economic dilemma.

However, wilful non-declaration of the holdings is not. US citizens are needed to state properties worth over US$ 10,000 in overseas accounts. With increased tax openness and also tightening up of global guidelines, it has come to be extra difficult for individuals to open up offshore accounts. The global crackdown on tax evasion has actually made offshore much less eye-catching as well as Switzerland, specifically, has seen a decline in the variety of offshore accounts being opened.

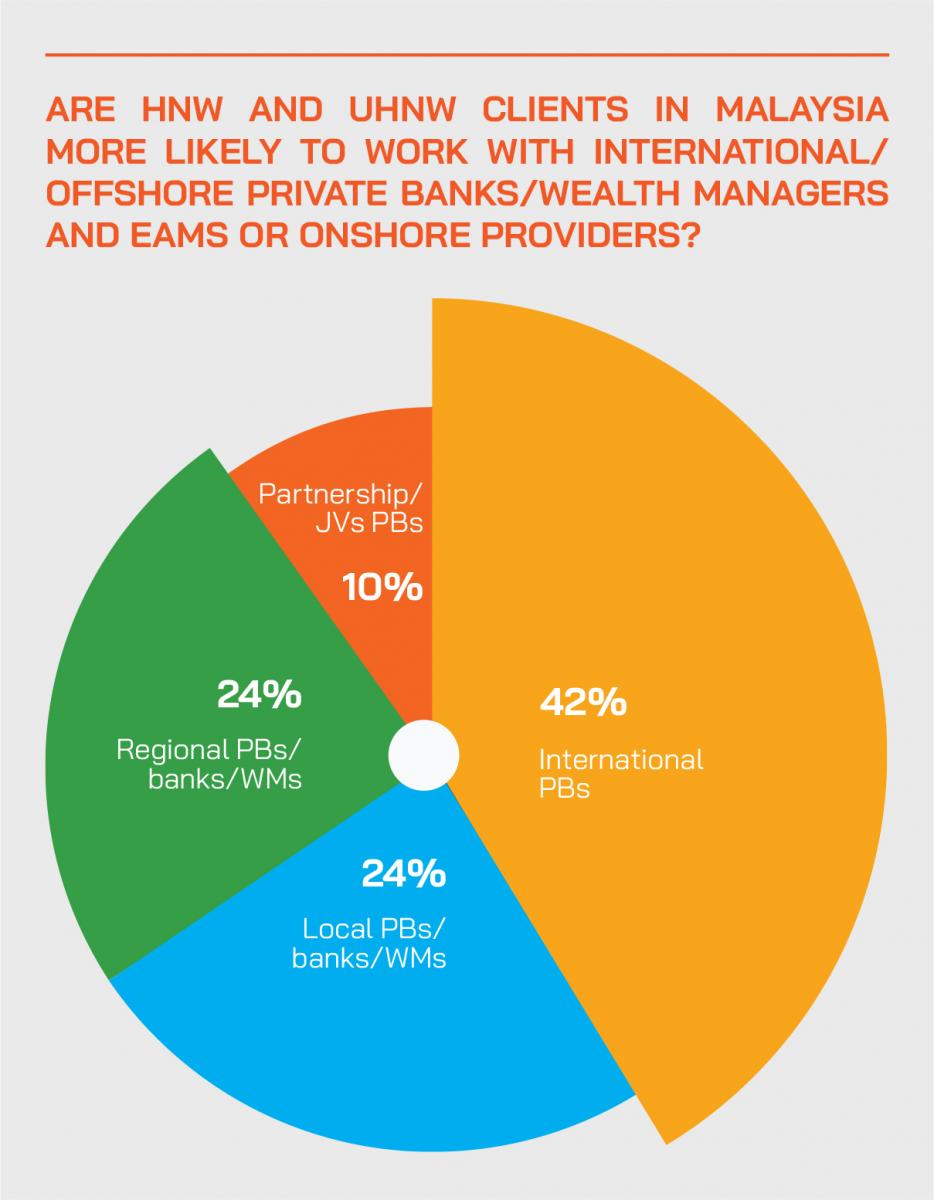

Onshore, offshore or a mix of the two will compose a private lender's client base. The equilibrium for every lender will be different relying on where their customers wish to reserve their properties. Dealing with offshore customers needs a somewhat various approach to onshore customers and advice can consist of the adhering to for the banker: They may be needed to cross borders to visit customers in their residence nation, also when the financial organization they come from does not more info here have an irreversible facility situated there, Possibly take full duty for managing profile for the customer if the customer is not a local, Be multilingual in order to effectively connect with clients as well as build their customer base worldwide, Understand worldwide regulations as well as guidelines, specifically when it come to offshore investments and tax obligation, Have the ability to link their customers to the right professionals to aid them with different areas from tax obligation via to even more practical support such as helping with home, moving, migration consultants and education experts, Know the current problems influencing international customers and ensure they can develop options to satisfy their demands, The financial institution and also details group within will certainly identify the populace of a banker's client base.

The 15-Second Trick For Offshore Wealth Management

Connects to the larger monetary services market in overseas facilities Offshore investment is the keeping of cash in a territory various other than one's country of home. Offshore territories are utilized to pay much less tax obligation in many countries by big and also small capitalists. Poorly regulated offshore domiciles have served historically as places for tax obligation evasion, cash laundering, or to hide or shield unlawfully acquired money from police in the financier's nation.

The benefit to overseas investment is that such procedures are both legal as well as much less expensive than those provided in the investor's countryor "onshore". Locations preferred by financiers for reduced prices of tax are called overseas economic centers or (often) tax havens. Payment of much less tax obligation is the driving force behind the majority of 'offshore' activity.

Commonly, taxes levied by an investor's residence nation are essential to the profitability of any type of offered financial investment - offshore wealth management. Utilizing offshore-domiciled unique purpose devices (or vehicles) an investor may minimize the quantity of tax obligation payable, allowing the investor to accomplish better profitability generally. Another reason why 'offshore' financial investment is considered remarkable to 'onshore' financial investment is because it is less managed, and the behavior of the offshore investment service provider, whether he be a banker, fund supervisor, trustee or stock-broker, is freer than maybe in a much more regulated setting.

Offshore Wealth Management Things To Know Before You Get This

Safeguarding versus currency devaluation - As an instance, redirected here Chinese capitalists have actually been investing their savings in steady Offshore areas to shield their versus the decline of the renminbi. Offshore investments in improperly managed tax obligation places may bypass permissions against countries developed to encourage conventions crucial to cultures (e.Corporations are easily created in Panama and, although they are heavily taxed on Exhausted operations, procedures pay no taxes on tax obligations activities. As a result, more than of 45,000 offshore shell firms and subsidiaries business are created in Panama each year; Panama has one of the highest focus of subsidiaries of any type of country in the globe.